td ameritrade taxes explained

For a partly dismantled piece of financial legislation dating to the Great Depression the Glass-Steagall Act remains strikingly relevant today. Harmonic Patterns are a type of complex patterns that occur naturally in financial charts based on geometric price action and Fibonacci levels.

In fact NFT taxes work similarly to cryptocurrency taxes meaning you need to accurately report your capital gains and activity.

. In the thinkorswim platforms Scan Stock Hacker tab select the flame at the top right that represents the Sizzle Index. Are separate but affiliated subsidiaries of TD Ameritrade Holding Corporation. Lets suppose you have that mortgage balance of 150000 at an interest rate of 325 and a monthly payment of 1100 per month.

Benzinga shows you how to read a stock chart and fully understand it. TD Ameritrade Holding Corporation is a wholly owned subsidiary of The Charles Schwab Corporation. TD Ameritrade does not provide tax advice.

When self-employed youre responsible for income taxes ranging from 10 to 37 of your net profit and a self-employment tax of 153. Stock charts are essential for understanding how stocks are being traded. TD Ameritrade Media Productions Company is not a financial adviser registered investment advisor broker.

Cash App Taxes has a somewhat better product and the price is free but it. Learn about the best performing no-load mutual funds that you can add to your portfolio based on growth expenses and more. If you expect to owe more than 1000 in federal taxes youre required to pay estimated quarterly taxes.

Gartley created a pattern which he named after himself and outlined in his 1935 book Profits in the Stock Market. Intelligent order routing - Enter stock orders knowing that were committed to route your order quickly to pursue execution at the best available price. The patterns were introduced to the trading world by Harold McKinley Gartley in 1932.

If you paid 20000 for a stock a few years ago. When properly identified harmonic. Below is a chart with momentum plotted against the price movements of the SP 500.

You may also owe taxes to your city and state governments. Scan All Optionable Stocks. For example TD Ameritrades thinkorswim platform has a tool known as TTM Squeeze that you can use to highlight when the transition between a trend and a consolidation is likely to happen.

Many financial advisors would pull out a calculator and show you a linear projection that keeps your 150000 invested with them makes an average of 7 per year and nets you 35 after accounting for mortgage interest before calculating your. TD Ameritrade Media Productions Company and TD Ameritrade Inc. If youre wondering how to file taxes for NFTs and how you can track your income our NFT tax guide is for you.

You pay taxes on the value of the assets you transfer. Why choose TD Ameritrade for stock trading No subscription or platform fees - Get access to any of our trading platforms streaming news and expert research without an additional fee. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

This will prefill the Stock Hacker with the parameters to find the securities with a per-share price above 5 volume above 100000 shares and market cap above 35MM that have the most unusual options volume.

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

.png)

Tax Loss Harvesting Wash Sales Td Ameritrade

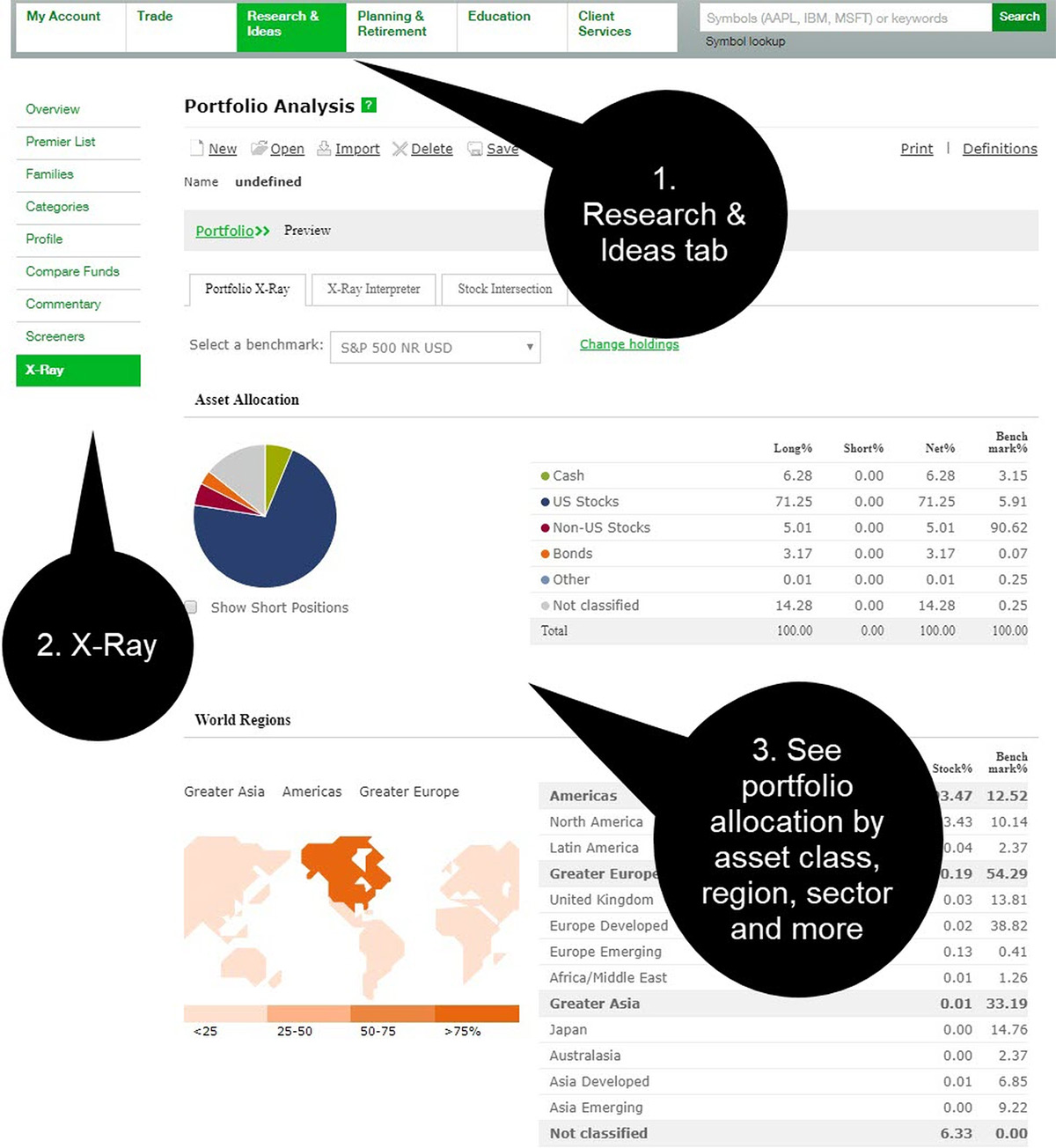

See Your Allocations From The Inside Out With Portfol Ticker Tape

Td Ameritrade Minimum Deposit And More Useful Information

Looking Beyond Allocation For A Well Diversified Port Ticker Tape

Learn How To Place Trades And Check Orders On Tdameri Ticker Tape

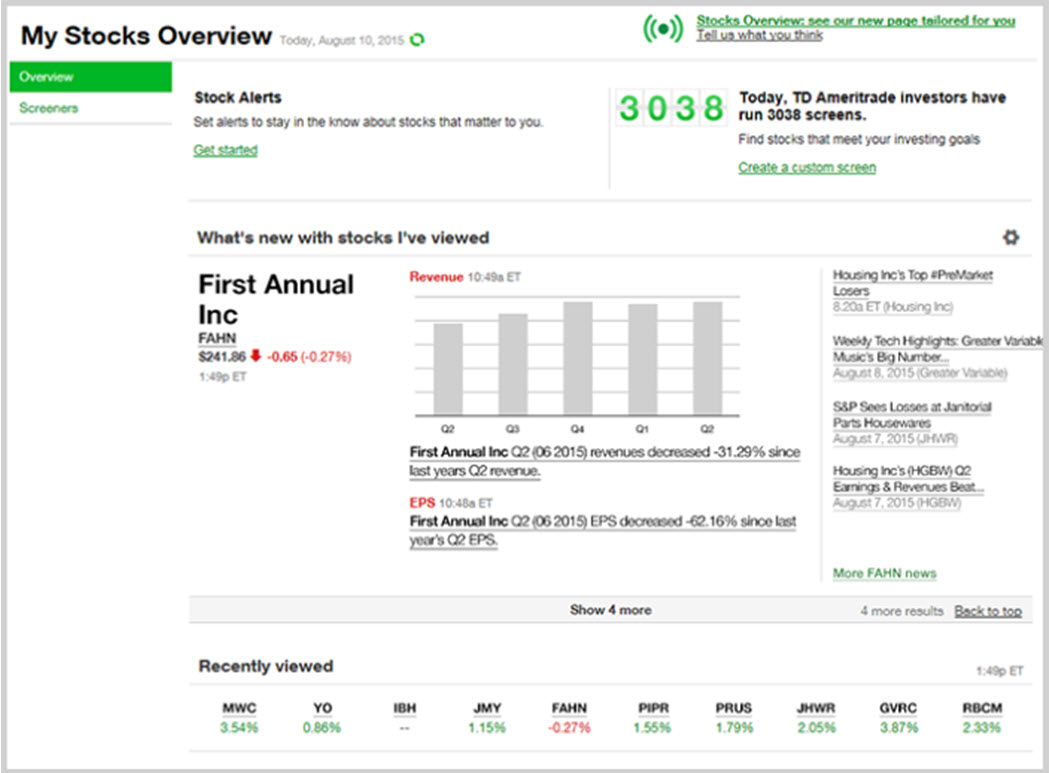

3 Reasons To Visit Stocks Overview Every Market Day Ticker Tape

Td Ameritrade Launches Tax Loss Harvesting Tool For Investors Business Wire